Form 26AS has been updated by the Internal Revenue Service to contain more and more information. Gone are the days when filing IT returns required manually downloading Form 26AS. Your Tax Credit Statement, also known as Form 26AS, is an important tax document.

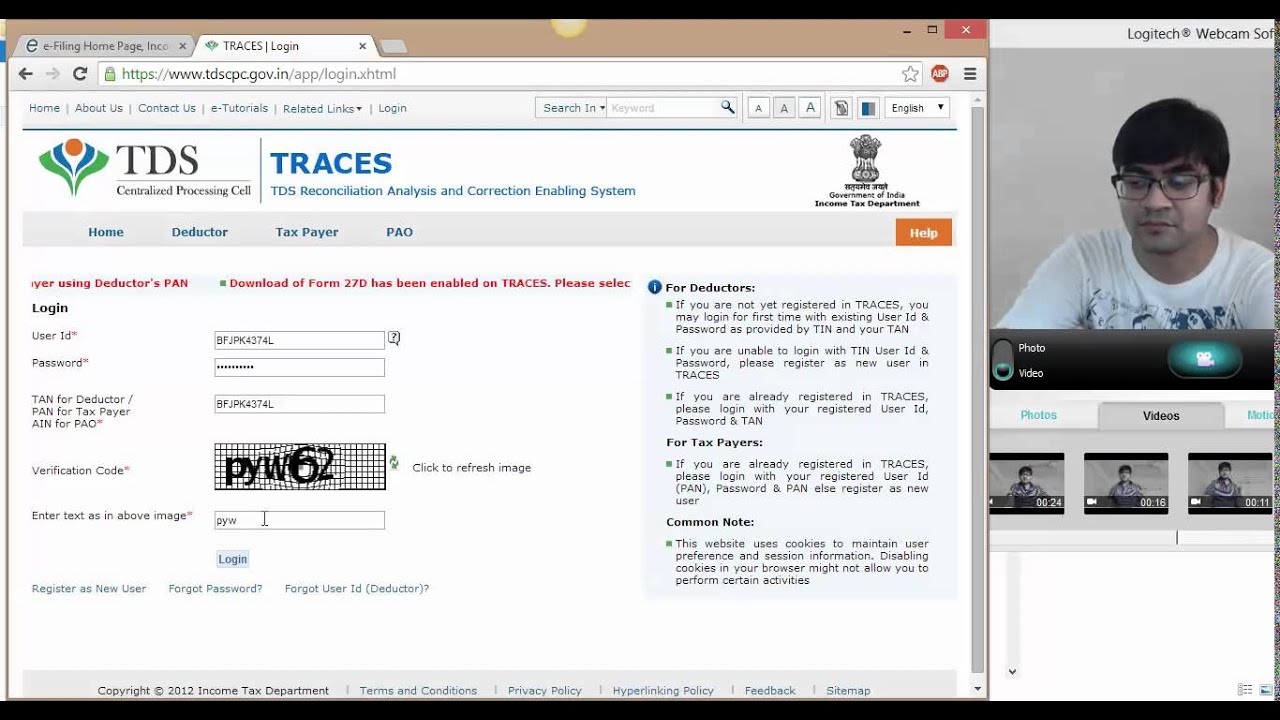

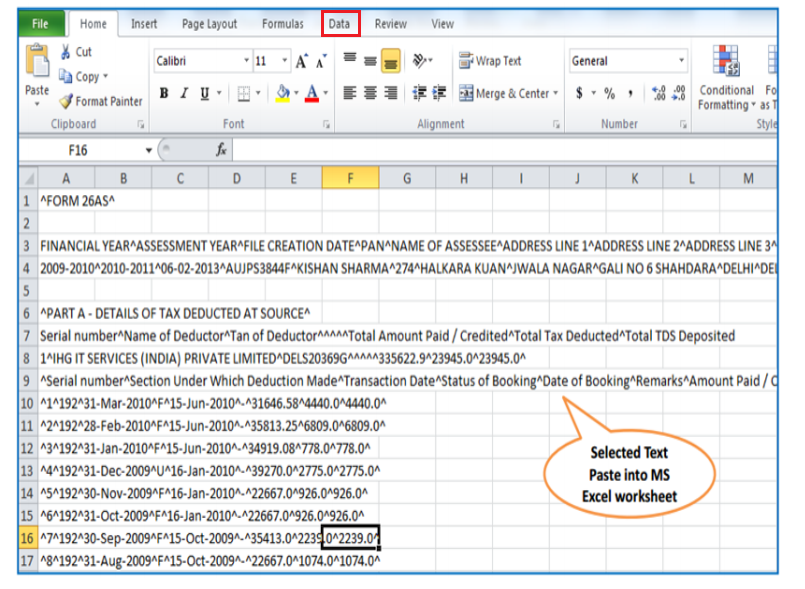

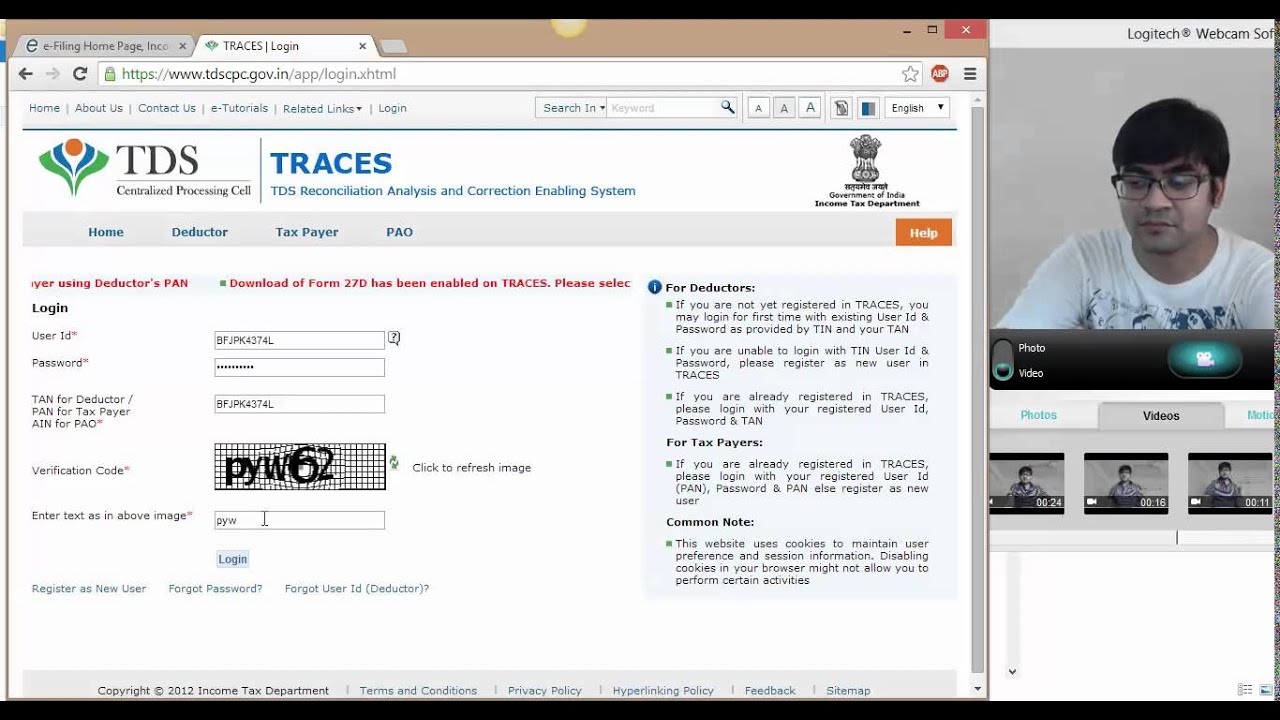

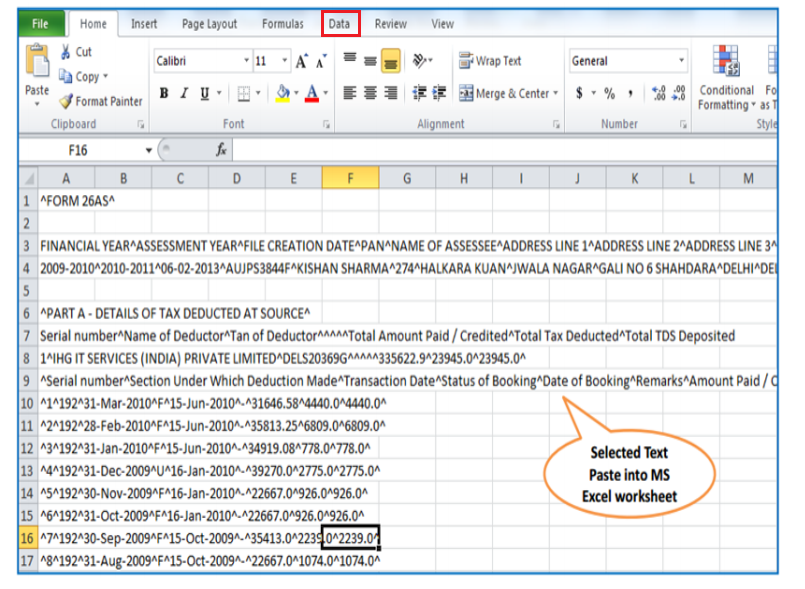

The new Form 26AS is split into two sections:. Information on new reforms for Form 26AS of Income Tax. How to Download Form 26AS of Income Tax?. So, this is the procedure where how you can download the Form 26AS. Next, Click View Tax Credit (Form 26AS/Annual Tax Statement) to view your Form 26AS/Annual Tax Statement, as reflected below:Īfter that, follow the procedure as below in image i.e., select Assessment year and type of view you want to see.Īfter selecting you can download the form by clicking on ‘View/Download’ Button and can also see the form below. Step 4: After you click on View Form 26AS, the below mentioned dialogue box will appear on that you have to click on “Confirm” and one clicked, the page will take you to an external site where you can see the different inputs which required to be feeded, after that it will reflect you the required year Form 26AS statement in front of you. Step 3: From these tabs, you have to click on e-file, then after on Income tax returns, and after on view Form 26AS, as also reflected in below image: Step 2: After you login, the page will display in front of you where you will be able to see different headings tab such as Dashboard, E-File, Authorised Partners, etc. Step 1: First of all, log in to your Income Tax ID with the help of User ID and Password. Now understanding how to download form 26AS from the TRACES Site: If you carried out any high-value transactions throughout the year, form 26AS will additionally include a record of such transactions.

The new Form 26AS is split into two sections:. Information on new reforms for Form 26AS of Income Tax. How to Download Form 26AS of Income Tax?. So, this is the procedure where how you can download the Form 26AS. Next, Click View Tax Credit (Form 26AS/Annual Tax Statement) to view your Form 26AS/Annual Tax Statement, as reflected below:Īfter that, follow the procedure as below in image i.e., select Assessment year and type of view you want to see.Īfter selecting you can download the form by clicking on ‘View/Download’ Button and can also see the form below. Step 4: After you click on View Form 26AS, the below mentioned dialogue box will appear on that you have to click on “Confirm” and one clicked, the page will take you to an external site where you can see the different inputs which required to be feeded, after that it will reflect you the required year Form 26AS statement in front of you. Step 3: From these tabs, you have to click on e-file, then after on Income tax returns, and after on view Form 26AS, as also reflected in below image: Step 2: After you login, the page will display in front of you where you will be able to see different headings tab such as Dashboard, E-File, Authorised Partners, etc. Step 1: First of all, log in to your Income Tax ID with the help of User ID and Password. Now understanding how to download form 26AS from the TRACES Site: If you carried out any high-value transactions throughout the year, form 26AS will additionally include a record of such transactions.

Your Form 26AS will reflect the amount of TDS that was deducted as well as the section under which it was done so and the total amount of TDS that was deducted. The amount of income we generated and any TDS provisions that applied to it meant that we had to pay TDS.

Earnings can take the form of the sale of real estate, a wage, lottery winnings, etc.

When we thoroughly understood the Form 26AS, we encountered many fields, including the amount of TDSthat was deducted from our wages. Form 26AS is an Income Tax form that records various transactions that occurred over the course of a fiscal year, such as fiscal year 2022-23.

0 kommentar(er)

0 kommentar(er)